Insightful Journeys

Explore a world of knowledge and information.

Instant Payout Systems: Cash at the Speed of a Click

Discover how instant payout systems revolutionize your finances—get cash at the speed of a click and transform your money management today!

Understanding Instant Payout Systems: How They Work and Why You Need Them

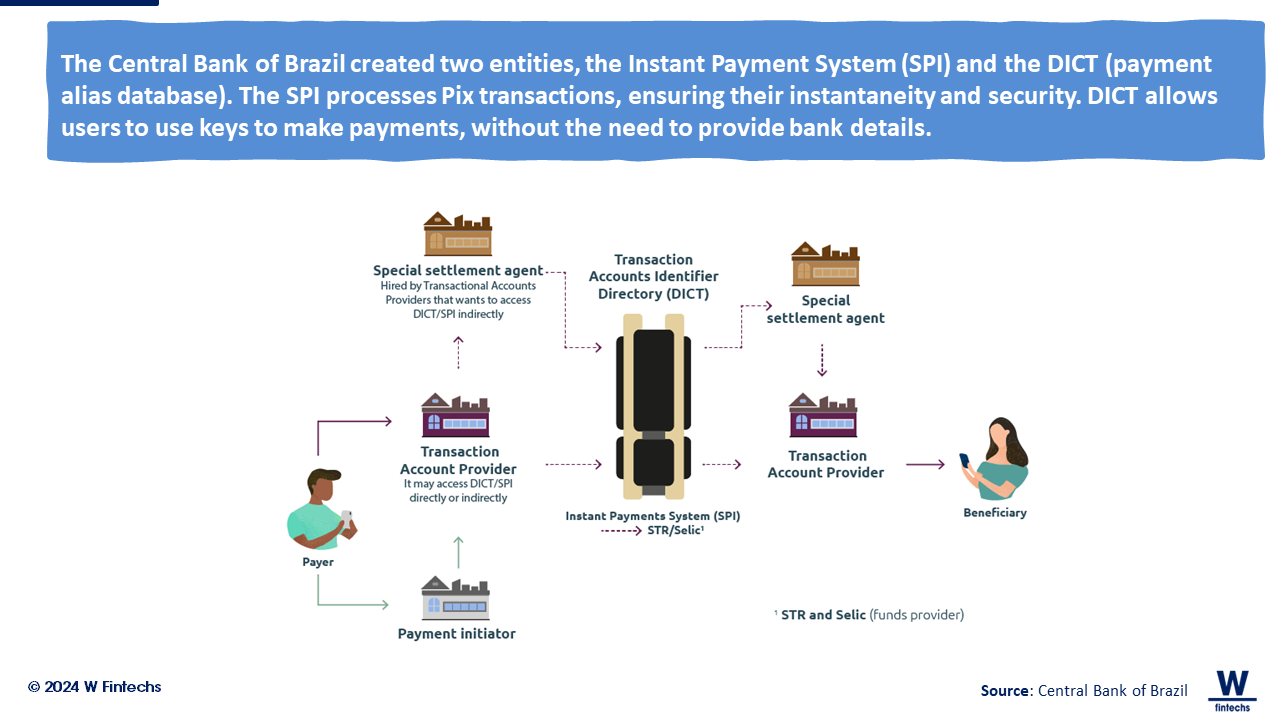

Instant payout systems are revolutionizing the way businesses handle transactions and manage cash flow. These systems enable companies to transfer funds to vendors, freelancers, and employees instantly, eliminating the traditional delays associated with payment processing. Understanding how instant payout systems work is crucial for any business looking to enhance efficiency and improve relationships with partners. Typically, these systems utilize digital wallets, blockchain technology, or peer-to-peer payment platforms, allowing users to receive their money within minutes, rather than days.

Adopting an instant payout system can provide a competitive edge in today’s fast-paced marketplace. One of the primary reasons you need these systems is to enhance customer satisfaction. For businesses that rely on gig workers or freelancers, prompt payments can lead to higher satisfaction rates and better retention. Moreover, companies can improve their operational efficiency by minimizing the administrative burden of traditional invoicing and payment processes. In a world where time is money, instant payouts can significantly boost productivity and foster trust among stakeholders.

Counter Strike is a highly popular tactical first-person shooter game that emphasizes teamwork and strategy. Players can choose to be part of either the terrorist or counter-terrorist teams, engaging in various objective-based gameplay modes. One way to enhance your gaming experience is by using a clash promo code which can provide special benefits or bonuses while playing.

Top Benefits of Instant Payouts: Fast Cash Flow for Your Business

Instant payouts are revolutionizing the way businesses manage cash flow. By offering fast cash flow, companies can address financial obligations, invest in opportunities, and improve overall operational efficiency. Unlike traditional payment methods that can take days or weeks to process, instant payouts ensure that funds are available almost immediately, allowing businesses to stay agile and responsive to market demands.

One of the most significant advantages of instant payouts is the ability to enhance customer satisfaction. When clients know that they can receive their funds quickly, it fosters trust and improves relationships. Additionally, businesses can benefit from fast cash flow to minimize the impact of unexpected expenses, thus maintaining smoother operations and boosting employee morale by ensuring timely commission payouts or expense reimbursements.

Are Instant Payouts Right for You? Exploring Pros and Cons

When considering whether instant payouts are right for you, it's essential to weigh the advantages and disadvantages. One major pro is the immediate access to your earnings. This feature can significantly improve cash flow, allowing you to reinvest in your business or handle unexpected expenses promptly. Additionally, instant payouts can enhance customer satisfaction, particularly in businesses that thrive on quick transactions, such as gig economy platforms and online marketplaces.

However, there are also several cons to consider. First, instant payouts often come with higher transaction fees, which can erode your profit margins over time. Moreover, depending on the payout method, you might face limits on the amount you can withdraw instantly. It's also crucial to assess whether such a system aligns with your financial management practices; without proper planning, the convenience of instant payouts could lead to financial missteps. Thus, careful evaluation is required to determine if this payment model suits your individual needs.