Insightful Journeys

Explore a world of knowledge and information.

Insurance Quotes That Won't Break the Bank

Discover unbeatable insurance quotes that save you money without sacrificing coverage! Start saving today!

Affordable Insurance Options for Every Budget

Finding affordable insurance options is essential for individuals and families looking to protect their assets without breaking the bank. With a variety of policies available, it's crucial to consider factors such as coverage limits, deductibles, and the type of insurance that best suits your needs. Some popular options include:

- Health Insurance

- Auto Insurance

- Homeowners or Renters Insurance

- Life Insurance

When selecting an affordable insurance plan, it's important to shop around and compare quotes from multiple providers. Utilizing online comparison tools can save you time and help you identify the best deals available. Additionally, many companies offer discounts for bundling policies or maintaining a clean driving record. Remember, being proactive in your search can lead to substantial savings and ensure that you find the right coverage for your financial situation.

How to Get the Best Insurance Quotes Without Overpaying

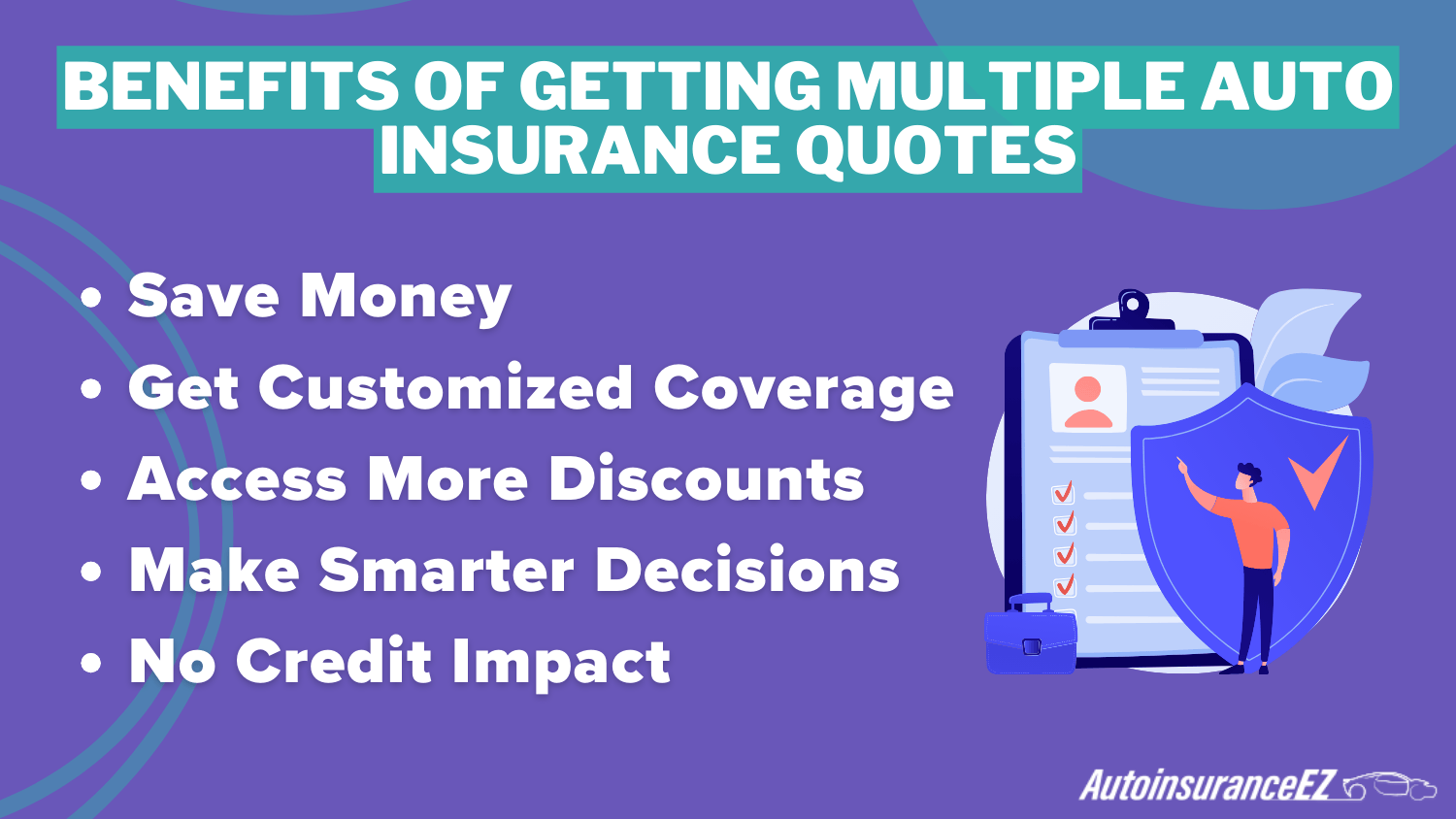

Finding the best insurance quotes without overpaying can seem daunting, but with the right approach, it can be a straightforward process. Start by gathering multiple quotes from various insurance providers. Use comparison websites to streamline this process, allowing you to evaluate coverage options and premiums side by side. Additionally, consider reaching out directly to independent agents who can provide personalized assistance and potentially uncover discounts that online platforms may not reveal.

Tip: Always review the coverage details carefully before making a decision. It's essential to balance cost with the level of protection provided. You might be tempted to choose the cheapest option, but this could leave you underinsured. By assessing factors such as deductibles, coverage limits, and customer reviews, you can make an informed choice that ensures you get the best deal without sacrificing quality. Remember, the lowest quote might not always represent the best value.

What Factors Influence Insurance Quotes and How to Lower Them?

When seeking insurance quotes, various factors influence the pricing that individuals should be aware of. Key aspects include your age, location, driving history, and the type of coverage desired. For instance, younger drivers often face higher premiums due to their inexperience on the road, while urban areas may lead to increased costs due to higher accident rates. Additionally, the type of vehicle being insured plays a significant role, as high-performance cars can lead to elevated quotes. Other factors to consider include your credit score and claims history, both of which can dramatically affect your premium rates.

To effectively lower your insurance quotes, consider implementing several strategic measures. Firstly, compare quotes from multiple insurance providers to ensure you are getting the best rate available. Bundling different types of insurance, such as car and home insurance, can also yield discounts. Furthermore, raising your deductible can lower your premiums, but make sure you choose a deductible amount that you can comfortably afford in the event of a claim. Lastly, maintaining a clean driving record and improving your credit score can lead to significant savings over time.