Insightful Journeys

Explore a world of knowledge and information.

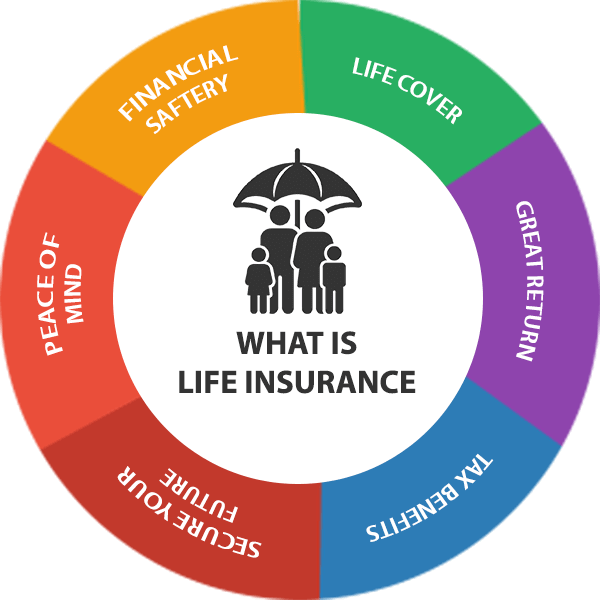

Life Insurance: Your Safety Net in the Chaos of Life

Discover how life insurance can be your ultimate safety net, providing peace of mind amid life's unpredictability. Protect your future today!

Understanding the Basics: How Life Insurance Provides Financial Security

Understanding the basics of life insurance is essential for anyone looking to secure their financial future. At its core, life insurance is a contract between the insured and the insurer, providing a monetary payout to beneficiaries upon the insured's death. This payout can serve various purposes, such as covering funeral expenses, clearing debts like mortgages or credit cards, and providing for the ongoing living expenses of loved ones. Essentially, life insurance acts as a financial safety net, ensuring that your family is protected from sudden financial burdens during a challenging time.

Moreover, different types of life insurance policies cater to diverse needs, enabling individuals to choose the one that best suits their circumstances. For example, term life insurance provides coverage for a specified period, making it an economical choice for young families needing temporary protection. In contrast, permanent life insurance offers lifelong coverage and can accumulate cash value over time, serving as an investment component. By grasping these fundamental concepts, individuals can make informed decisions about how life insurance can effectively contribute to their overall financial security and peace of mind.

Top 5 Myths About Life Insurance Debunked

When it comes to life insurance, misinformation can lead to costly misconceptions. One common myth is that only older individuals or those with serious health issues need life insurance. In reality, everyone can benefit from life insurance, regardless of age or health status. This protection not only provides financial security for loved ones but can also act as a long-term investment vehicle.

Another prevalent myth is that life insurance is too expensive for the average person. However, many people are surprised to find out that life insurance policies can be quite affordable, especially if purchased at a young age. By shopping around and comparing different policies, individuals can find coverage that fits within their budget while still offering the necessary protection for their families.

Is Life Insurance Right for You? Key Questions to Consider

When considering whether life insurance is right for you, it's important to assess your individual financial situation and needs. Ask yourself key questions such as:

- What are my current financial obligations?

- Do I have dependents who rely on my income?

- What would happen to my family's finances if I were to pass away unexpectedly?

Another critical factor to consider is your long-term financial goals. Think about how life insurance may fit into your broader financial plan. Would it help you cover debts like a mortgage or student loans, or could it serve as a financial safety net for your children’s education? Reflect on these questions to evaluate if investing in a life insurance policy aligns with your priorities and provides peace of mind in securing your family's financial future.